Manufacturing in Mexico vs China: Which One is Best for Your Company

For two decades manufacturers have seen a factory in China as a way to cut costs and remain competitive. However, a growing number of business owners and managers understand this is no longer the best option.

There are other low-cost countries in Asia but there’s another location that’s closer to home: Mexico.If you’re currently exploring ways to lower your production costs, a comparison of manufacturing in Mexico vs China should be of interest.

Key Considerations

Yes, the single biggest reason for exploring manufacturing in Mexico or China is that both have lower labor costs than the US, Canada or Western Europe. However, there are other factors to consider as well.

On this article, we will compare the following 4 key factors:

- Labor costs

- Supply chain issues

- IP issues

- Communication

1) Labor Costs

Direct comparisons are difficult and hourly wages only tell part of the story. Productivity and exchange rates must also be considered if we are to understand the true cost situation.

Within both Mexico and China labor costs vary by region and industry. In Mexico earnings tend to be higher in states bordering the US and in China they rise with proximity to ports. A decade or more ago China held a significant advantage, but this is no longer the case as rising pay and changes in productivity, along with exchange rate movements, have brought the two countries into parity. As the Boston Consulting Group report “How Shifting Costs Are Altering the Math of Global Manufacturing” noted, from 2015 to 2018 the dollar rose 4% against the yuan, and 8% against the peso. Today ~ $4 per hour is typical for both.

The same BCG study also considered other cost factors, especially energy, to arrive at a Global Manufacturing Cost-Competitiveness Index. Taking U.S. costs as the baseline at 100, China scored 93 to 95, while Mexico came in at 86.

It’s cheaper to manufacture in Mexico than in China.

2) Supply Chain Issues

Distance to market and lead time are linked, and the longer the lead time the more inventory in the supply chain. That creates two problems:

- Money tied up

- Reduced flexibility

The impact of increased inventory on cash should be obvious. The hit to flexibility may be less clear, so consider a B2C example: what if demand for a product shifts suddenly? The factory quickly changes over, but there are containers of old product travelling towards the US warehouses. Long lead time can mean discounting this while failing to satisfy the new demand.

Or, a B2B example: on receipt at a US assembly plant material used in a key component is found to be out of specification. A longer supply chain means more product to scrap and a longer delay in getting replacement components.

When it comes to supply chain management, geography favors Mexico.

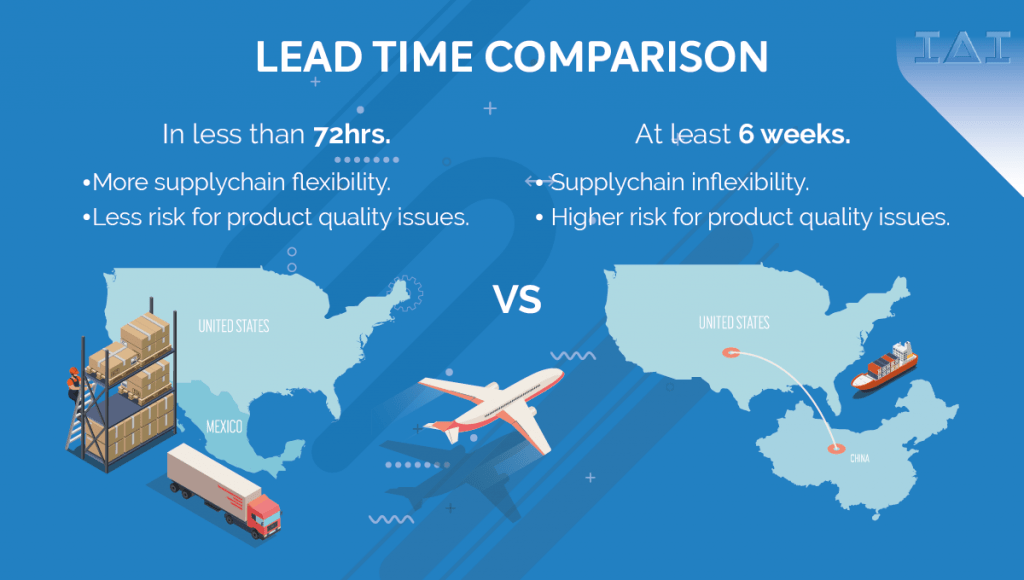

A truck leaving Matamoros in northern Mexico can be on the US east coast or in the Midwest in less than 72 hours. A container from China needs at least six weeks. This is why you find many major industry clusters along the US-Mexico border.

3) IP issues

For many manufacturers, patents, trade secrets, trademarks and copyright are essential to their success. They need to know this IP is not going to find its way to competitors.

Mexico’s stance on IP is very similar to that of the US. Manufacturers can be confident in their ability to protect key IP. The situation in China is less clear.

In a 2018 interview for a Stanford Law School blog, “Intellectual Property and China: Is China Stealing American IP?”, Professor Paul Goldstein said, “Although piracy and counterfeiting remain issues in China, the two newer forms of siphoning off foreign IP value are theft—often cyber theft—of extraordinarily valuable trade secrets and know-how, and the technology transfers required … as a condition to doing business on Chinese soil.”

Furthermore, a 2019 Special Report from the Office of the US Trade Representative (USTR) says, “China’s placement on the Priority Watch List reflects the urgent need for fundamental structural changes to strengthen IP protection and enforcement, including as to trade secret theft, online piracy and counterfeiting, the high-volume manufacture and export of counterfeit goods, and impediments to pharmaceutical innovation.”

In a comparison of manufacturing in Mexico vs China, don’t overlook the need to protect your IP.

Communication

Chinese factories are some 12 hours ahead of the US: Mexican factories are in the same time zones. That makes direct communication easier and faster.

While Mexico has a different language and culture to that of the US, Spanish speakers are not hard to find south of the US border, and most Mexicans in managerial roles speak excellent English.

Ease of communication is an advantage of manufacturing in Mexico that’s intangible until something goes wrong. When a problem arises it’s much easier to call someone in Tamaulipas than in Wuhan.

Getting Started in Mexico

China is known as a low-cost manufacturing location but it’s far from the only option for manufacturers seeking to become more competitive.

As this comparison of manufacturing in Mexico vs China has shown, the US’s southern neighbor has the edge in several areas.

Of the proven strategies to start manufacturing in Mexico the route that works best for many companies is partnering with a Manufacturing Services company.

IAI Mexico provides manufacturing services to businesses eager to tap into the advantages Mexico offers. Start a conversation by calling, emailing or using the “Contact Us” link on our website.